Start teaching clients today—30 client education presentations (FINRA‑reviewed).

Learn More

Show clients you’re in control and ready to discuss what new 2024 key rates mean for them.

Learn More

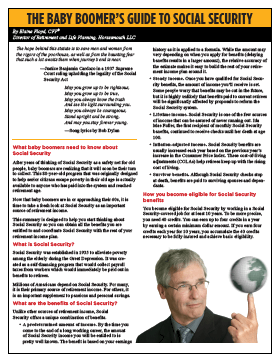

Every day more Baby Boomers approach retirement and they want to know the ins and outs of Social Security. Become the expert your clients need with Savvy Social Security Planning for Boomers, a fully-supported, year-long program. Includes:

Everyone must sign up for Medicare, yet few people understand what to do. Help clients avoid the pitfalls and put this critical piece of the retirement planning puzzle into place with Savvy Medicare Planning for Boomers, a fully-supported, year-long program. This program allows you to:

Enjoy new levels of trust and credibility when you help parents save money and keep their sanity as they search for the colleges that are right for their kids. With this program you can:

Get the critical IRA expertise you need to safely guide your clients past the tax booby traps embedded in every retirement account. Don’t lose your share of the $22 trillion retirement market! Add Savvy IRA Planning to your business today. Includes:

Generational Planning is a modern, forward-thinking, and intentional two-phase process of first passing on a family’s tangible wealth and assets, and secondly, conveying its values and history, all for the benefit of the next generation.

The program has three phases. The first focuses on legacy planning, the second on generational planning and the third phase focuses on COI team building.

Educating clients and prospects on the importance of developing a long-term care plan is a smart move for advisors. You don’t want other professionals taking the lead here (But you will want to work collaboratively with experts in elder care, estate planning, and insurance).

That’s why we’ve created the Savvy Long-Term Care Planning program. Your clients (and prospects) will be grateful to you for your attention to this difficult, critical issue.

Help protect clients and prospects from the growing epidemic of identity theft, credit card fraud, phishing scams, and ruinous hacks.

Help retirees pay lower taxes by developing a retirement tax planning strategy—they’ll love you for it and refer you!

Master Membership is the answer for advisors who want to power their business with Horsesmouth. Get all our programs with a single Master Membership. Includes:

This flexible, continuous, year-round program works on three key aspects of your business: prospecting, marketing and client communications. Includes:

Finally, a CPA/COI strategy that demonstrates your value and expertise and builds two-way trust that boosts your client service and referrals. Includes:

Proven advice and over 13,000 articles from 45+ veteran advisors and industry experts offering insights, answering questions, and solving problems. Includes:

Deepen your understanding of the nuances, learn the range of claiming strategies, and build your base of Social Security and Medicare expertise.

Learn to transform your approach to add new clients with greater ease and efficiency. The Discovery Meeting Workshop is our industry’s only two-day, research-based, virtual workshop that:

Join us for an intensive immersion in tax planning where you’ll discover the skills, concepts, and strategies needed to assist clients and position yourself as the go-to tax-smart advisor in your markets. Led by industry expert Debra Taylor, CPA/PFS, JD, CDFA; co-creator of Horsesmouth’s Savvy Tax Planning program.

A total immersion experience taking you through a complete review of the various parts of Medicare, what’s covered under those parts, when to enroll in Medicare, how your current employment status affects your Medicare decisions, how Medicare works with your private insurance, what you need to review with your clients both before and after they take Medicare, and how Medicare (and other topics) can work in the context of workshop marketing for business development purposes.

Help your clients make smart and responsible decisions about long-term care planning. This handy resource is packed with information about the different ways to pay for long-term care and considerations to take in for each option. Topics addressed on the card include:

55 questions everyone needs to answer by December 31st—your fall 2023 client and prospect campaign.

The Time in the Markets and the Power of Compounding handout is a versatile resource that can be used to enhance your client relationships and reinforce your expertise as a financial advisor.

This valuable educational tool is designed to help your clients see market fluctuations from a long-term perspective. It highlights the importance of staying invested and the power of compounding, empowering your clients to make informed decisions and avoid knee-jerk reactions.

When you pass along a 2024 Key Financial Data Card to clients, prospects and allies, there’s no easier and simpler way to remind people of your commitment, expertise, and professionalism.

Make 2024 Key Financial Data part of your marketing efforts for next year. It’s a sound investment in the data that you need to help clients succeed.

Order PDF Only

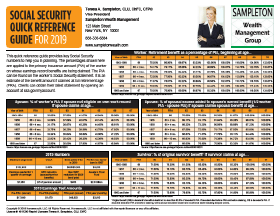

No more digging around on the shelves or searching on the Internet for information like:

People need concise, objective and easy to understand information about Medicare. Now you can give them just that with the Medicare Quick Reference Guide.

This branded 8.5" x 11" reference includes critical Medicare information about which programs apply to which people; when to apply, information about premiums and deductibles, and references to other resources with more information.

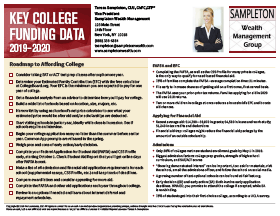

Paying for college is the biggest expense families face after buying a home. Help them save thousands on tuition and protect their retirement savings from bad college funding decisions.

Start by educating parents about the realities of paying for college—it’s not about 529 savings plans—by sharing with them your custom copy of Horsesmouth’s new Key College Funding Data card.

The card includes more than 60 helpful data points organized in 11 topic areas.

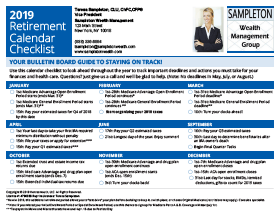

Remove a little pain from your clients’ lives by acting as their retirement guide star over important dates, details, and deadlines throughout the year.

Retirees want to travel, enjoy grandchildren, and pursue new interests they couldn’t before. They want to keep stress to a minimum. That’s where the Retirement Calendar Checklist comes in. It has important dates in retirement life organized by month, with space to mark off each task after it is finished. Retirees can know at a glance what is coming up and what needs to be put on the “to-do” list over the next month.

Order PDF Only

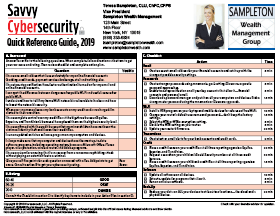

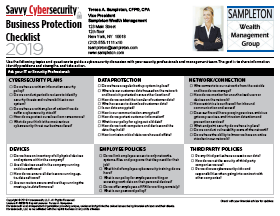

Who will show your clients how to fight the growing cybersecurity threat? It should be you—their financial advisor!

This two-sided reference card allows your clients and prospects to quickly measure their current cybersecurity knowledge gap. Then it provides specific actions they can take to quickly boost their security and protect themselves, their families, and even their jobs.

This two-sided, customizable checklist is the perfect resource for your business owner and executive clients. It’s designed to guide them through cybersecurity conversations with important business associates such as their IT team and CFO.

The goal of the Savvy Cybersecurity Business Protection Checklist is for business associates to share information, identify problems and strengths, and take action.

The checklist contains 40+ questions covering eight different cybersecurity topics, such as cybersecurity plans, data protection, employee policies, networks, and fraud prevention.

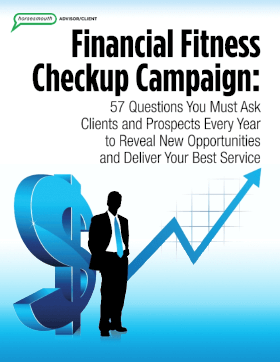

Now is the perfect time to look at various aspects of your client’s life and develop a plan to improve their financial fitness.

2023 Financial Fitness Checkup contains 57 questions that may have an impact on their financial health in 2022 and beyond. You mail it and they can check each question with a “yes” or “no” and write in any appropriate comments. You can then follow-up with a meeting to discuss.

Fewer people understand all that the federal government done through a variety of stimulus actions meant to bolster the economy and put more money in the pockets of Americans.

You need to know the details so you can help clients and prospects find relief and planning opportunities. Keep clients informed with this personalized handout that lists the latest rules and assistance programs.

The biggest retirement-related legislation in over a decade finally became law at the tail end of 2019. Some of the biggest changes will impact your clients, like the death of the stretch IRA and the ability to contribute to IRAs after age 70. SECURE Act 2.0, introduced at the end of 2022, brings even more changes.

Do your clients know that their heirs need to liquidate and inherited IRA within 10 years? Do new parents know they can withdraw up to $5,000 each from a retirement plan to pay for new child expenses? Have you discussed how financial plans and distribution strategies need to change?

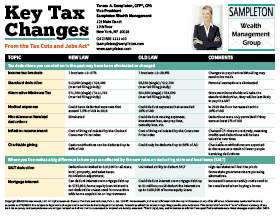

This informative card tells you what the new rules are and how they’re different from the old ones. It includes nearly all the changes affecting individuals and businesses.

Clients, prospects, and COIs will love Key Tax Changes because it’s simple and easy to comprehend at a glance. It tells you what the new rules are and how they’re different from the old ones. Nearly all the changes affecting family and business finances are included.

The Guide to Taxes and Your Retirement needs to be part of any discussion you have with clients and prospects.

Regardless of how you engage clients about taxes and retirement planning, this guide will help you make the critical connection between taxes and retirement

This 4-panel, 2-sided, 8.5" x 11" reference guide for clients reinforces your expertise and helps to explain key concepts every client must consider:

This 4-panel, 2-sided, 8.5" x 11" reference guide for clients reinforces your expertise and helps to explain how every client can consider and put in place a family caregiving plan. Topics include:

This 4-panel, 2-sided, 8.5" x 11" handout walks readers through the six steps of legacy planning and explains the importance of acting now. Topics include:

This 4-panel, 2-sided, 8.5" x 11" reference guide for clients reinforces your expertise and helps to explain key concepts every client must consider when making college planning decisions. Topics include:

This 4-panel, 2-sided, 8.5" x 11" reference guide for clients reinforces your expertise and helps to explain key concepts every client must consider when making IRA Planning decisions. Topics include:

This 4-panel, 2-sided, 8.5" x 11" reference guide gives your clients a solid overview of how Social Security works. Perfect to handout at client meetings about retirement income planning. Topics include:

Elaine Floyd, CFP®, Horsesmouth’s Director of Retirement and Life Planning, has worked to develop this client-resource on Medicare—one that addresses the basics, but also dives into the more advanced aspects of a complicated topic.

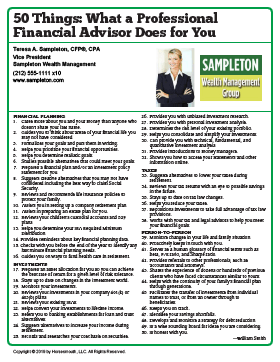

Sometimes you just gotta toot your own horn!

Because clients will forget how valuable you are. They don’t see the behind-the-scenes activities. They don’t realize all that goes into the check they get each month or the hours spent reviewing accounts.

So remind them of your value with this special reprint, “50 Things: What a Financial Professional Does for You.”

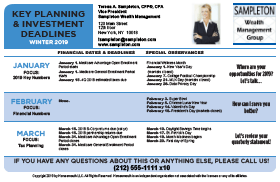

The Key Planning and Investment Deadlines Quarterly postcards covers key deadlines throughout the seasons. Details:

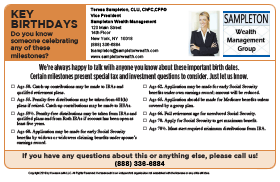

The Key Birthdays postcard is an ideal client touch with a lot of potential. It simply and clearly asks people if they know anyone crossing these landmark birth dates. Details:

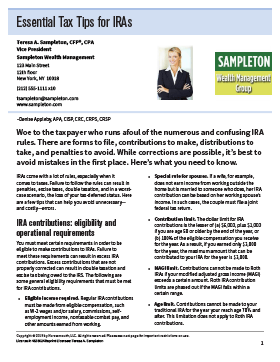

Now it’s easy to stay connected with clients and prospects by sending them top-rated Horsesmouth articles.

Our Article Reprints program gives you timely access to licensed articles you can present to clients and prospects at any time. You get:

We are excited to announce the second edition of our award-winning book. Learn the new cybersecurity rules that we must cultivate in order to achieve higher security: secrecy, omniscience, and mindfulness.

When you integrate Hack-Proof Your Life Now! and use it to protect yourself, you’ll never worry about getting hacked. You and your clients will learn the new cybersecurity rules to stay safe against the biggest cybersecurity threats we face every day.

The Financial Advisor’s Guide to the New Tax Law: Help Your Clients Make Smart Moves is the perfect resource for all the tricky details of the new law.

The new tax rules give you the opportunity to demonstrate your knowledge, your insights, and your professionalism by educating clients and prospects about the intersection of taxes and their plans to save, send kids to college, and retire. It shows you as a Financial Educator.

It’s a sad truth that few in this world really understand how difficult your job is and how rewarding it can be when pursued with passion, drive, determination, intensity, devotion and dedication.

You’ll find The Happy Advisor to be an endless source of inspiration and insight, one you can turn to again and again for just the right type of adjustment you need to keep on keeping on.